Offshore Company Formation : A Comprehensive Overview for Business Owners

Offshore Company Formation : A Comprehensive Overview for Business Owners

Blog Article

Approaches for Cost-Effective Offshore Firm Formation

When thinking about overseas business development, the pursuit for cost-effectiveness becomes a critical problem for businesses seeking to expand their procedures worldwide. In a landscape where monetary vigilance preponderates, the approaches used in structuring offshore entities can make all the difference in accomplishing financial efficiency and operational success. From browsing the complexities of territory selection to applying tax-efficient structures, the trip in the direction of developing an offshore visibility is rife with possibilities and difficulties. By discovering nuanced approaches that mix lawful compliance, economic optimization, and technical advancements, services can begin on a course towards overseas business formation that is both financially prudent and strategically sound.

Selecting the Right Territory

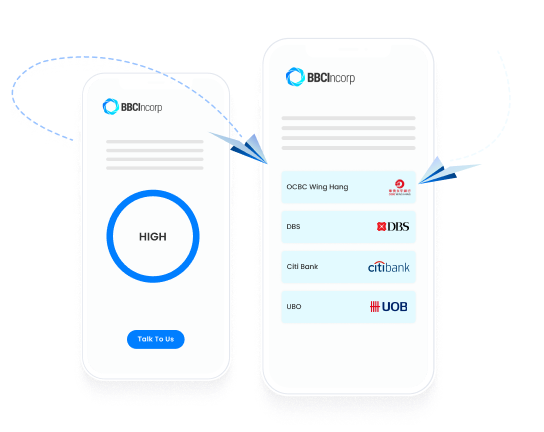

When establishing an offshore firm, selecting the appropriate jurisdiction is an essential choice that can dramatically impact the success and cost-effectiveness of the formation procedure. The territory chosen will establish the regulatory structure within which the business operates, influencing taxes, reporting requirements, personal privacy laws, and general company flexibility.

When choosing a jurisdiction for your offshore business, a number of elements need to be considered to guarantee the choice lines up with your tactical goals. One critical aspect is the tax obligation routine of the territory, as it can have a substantial effect on the company's earnings. In addition, the level of governing compliance required, the financial and political security of the jurisdiction, and the simplicity of operating should all be assessed.

In addition, the online reputation of the jurisdiction in the international service neighborhood is necessary, as it can affect the understanding of your business by customers, companions, and monetary organizations - offshore company formation. By thoroughly assessing these elements and seeking professional advice, you can choose the right jurisdiction for your offshore business that maximizes cost-effectiveness and supports your service purposes

Structuring Your Business Efficiently

To make sure optimum effectiveness in structuring your offshore firm, careful attention needs to be offered to the organizational framework. The initial step is to define the business's ownership structure plainly. This consists of figuring out the investors, directors, and police officers, along with their functions and duties. By developing a clear possession structure, you can guarantee smooth decision-making procedures and clear lines of authority within the business.

Next, it is necessary to take into consideration the tax obligation implications of the picked structure. Different territories provide varying tax advantages and motivations for overseas companies. By very carefully evaluating the tax obligation laws and policies of the picked territory, you can enhance your firm's tax obligation efficiency and decrease unneeded expenditures.

Moreover, keeping correct documents and records is essential for the efficient structuring of your offshore company. By maintaining precise and updated documents of financial purchases, corporate choices, and compliance records, you can make certain transparency and liability within the company. This not only facilitates smooth procedures yet likewise assists in demonstrating compliance with regulative requirements.

Leveraging Modern Technology for Financial Savings

Effective structuring of your overseas business not only pivots on meticulous attention to organizational frameworks but additionally on leveraging modern technology for financial savings. In today's digital age, innovation plays a crucial role in enhancing procedures, minimizing costs, and raising effectiveness. One means to take advantage of modern technology for cost savings in overseas firm development is by utilizing cloud-based solutions for information storage space and cooperation. Cloud technology removes the demand for expensive physical framework, lowers maintenance costs, and gives versatility for remote job. Furthermore, automation devices such as electronic signature platforms, accounting software application, and job monitoring systems can considerably reduce down on manual work prices and enhance total performance. Accepting online communication tools like video conferencing and messaging applications can also bring about cost financial savings by minimizing the requirement for traveling expenditures. By integrating modern technology tactically right into your offshore company development process, you can attain significant savings while enhancing functional efficiency.

Minimizing Tax Obligation Liabilities

Utilizing critical tax planning strategies can properly lower the monetary burden of tax obligation responsibilities for overseas firms. Furthermore, taking advantage of tax obligation motivations and exceptions supplied by the territory where the overseas firm is signed up can result in substantial financial savings.

Another approach to decreasing tax obligations is by structuring the offshore business in a tax-efficient fashion - offshore company formation. This entails meticulously making the possession and operational structure to optimize tax benefits. Establishing up a holding business in a territory with beneficial tax obligation laws can assist settle profits and reduce tax obligation direct exposure.

Additionally, staying upgraded on global tax policies and compliance demands is essential for lowering tax obligations. By guaranteeing strict adherence to tax obligation regulations and laws, overseas business can stay clear of pricey fines and tax obligation disagreements. Looking for professional guidance from tax obligation experts or lawful professionals focused on international tax obligation issues can additionally give useful insights into effective tax obligation preparation approaches.

Ensuring Compliance and Threat Mitigation

Implementing robust conformity actions is important for overseas business to alleviate threats and keep governing adherence. Offshore territories typically encounter boosted scrutiny because of worries relating to money laundering, tax obligation evasion, and other economic criminal offenses. To guarantee compliance and minimize dangers, overseas companies ought to perform comprehensive due diligence on clients and organization partners to prevent involvement in illicit activities. In addition, carrying out Know Your Client (KYC) and Anti-Money Laundering (AML) treatments can assist validate the legitimacy of transactions and safeguard the business's online reputation. Routine audits and browse this site evaluations of monetary records are crucial to recognize any type of irregularities or non-compliance issues quickly.

Furthermore, remaining abreast of changing guidelines and legal requirements is crucial for overseas business to adjust their compliance practices as necessary. Engaging lawful specialists or conformity specialists can provide important assistance on browsing complicated regulative landscapes and ensuring adherence to global requirements. By prioritizing conformity and danger reduction, overseas business can boost openness, construct depend on with stakeholders, and safeguard their operations click for more info from possible legal consequences.

Verdict

Utilizing calculated tax obligation preparation strategies can properly reduce the financial concern of tax obligations for offshore firms. By distributing revenues to entities in low-tax jurisdictions, offshore business can lawfully reduce their overall tax responsibilities. Furthermore, taking advantage of tax obligation motivations and exceptions offered by the jurisdiction where the overseas business is registered can result in substantial cost savings.

By guaranteeing rigorous adherence to tax obligation laws and regulations, offshore companies can stay clear of pricey fines and tax obligation conflicts.In verdict, economical overseas company formation needs mindful consideration of jurisdiction, effective structuring, innovation use, tax minimization, and compliance.

Report this page